Picture this: you're gone. And your family's blindsided.

They are facing a financial nightmare, juggling bills with the crushing weight of grief.

Sounds dramatic… but it could be a reality

Canada has the highest education levels in the world but the choices we make aren't adding up.

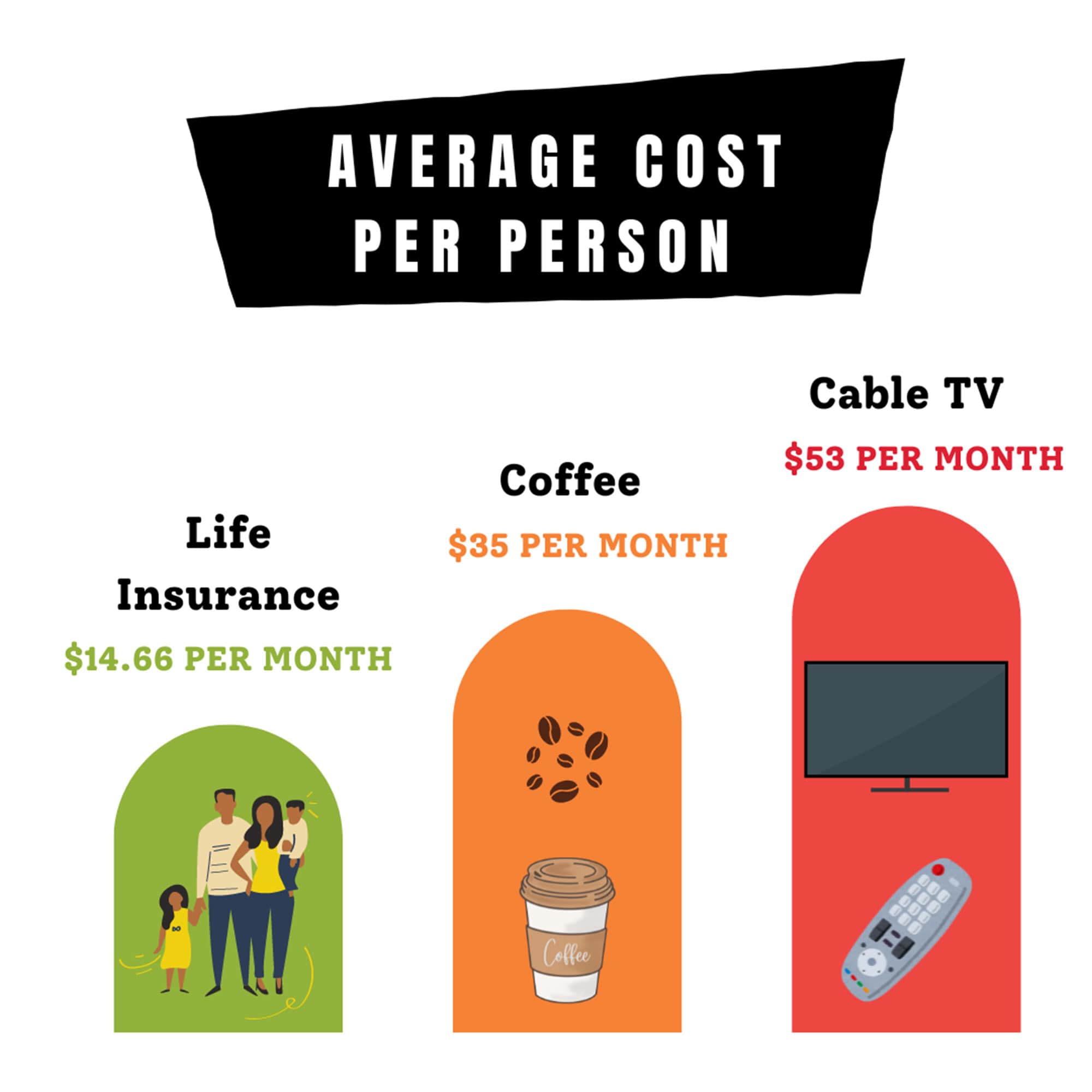

Each month the average Canadian spends around $53 on cable TV and $35 on coffee .

Yet nearly half of us don't have $15 per month life insurance to protect our family's future .

Sure, cable and coffee are nice but they won't pay the mortgage if you're not around.

Think about it. College funds, mortgage payments, even groceries – your family will need money when you're not around to earn it.

A $15 per month life insurance policy could secure a hefty $150,000 payout if you pass away .

Fifteen bucks. That's less than a movie ticket.

Don't be that person living well but leaving behind a financial bomb.

Life is unpredictable - we all know somebody that fate has taken away too soon. It's time to prioritize what matters most and protect your loved ones future.

You might even feel more content the next time you drink that latte or catch the playoffs.

Here's how:

>> Select your age below.

>> Answer a few quick questions (takes less than a minute) to request your quote.

Chatelaine

Madeinca

Policyme

Ratehub

$15 life insurance cost refers to a 10 year term life insurance plan with a $150,000 death payout for a 50 year old female non-smoker living in Ontario.